Starting a small business in the USA can be a rewarding and exciting endeavor, but it can also be challenging. There are many steps you will need to take in order to get your business up and running, but with the right planning and execution, you can be well on your way to success. Here is a step-by-step guide on how to start a small business in the USA:

- Determine your business idea: The first step to starting a small business is to determine what kind of business you want to start. This will depend on your interests, skills, and experience, as well as the needs of the market. Consider what products or services you can offer that will be in demand and that you are passionate about.

- Conduct market research: Once you have a business idea, it’s important to conduct market research to determine if there is a demand for your product or service. This can involve researching your target market, competitors, and pricing. This will help you to understand the potential for your business and make informed decisions about how to move forward.

- Write a business plan: A business plan is a detailed document that outlines the goals, strategies, and action plan for your business. It should include information about your target market, marketing and sales strategies, financial projections, and a description of your products or services. A business plan will help you to focus your efforts and stay on track as you work to launch and grow your business.

- Choose a business structure: There are several different business structures to choose from when starting a small business in the USA, including sole proprietorship, partnership, corporation, and limited liability company (LLC). Each type of structure has its own benefits and drawbacks, so it’s important to consider which one is right for your business.

- Register your business: Once you have chosen a business structure, you will need to register your business with the appropriate government agency. This will typically involve obtaining a business license and registering for state and federal taxes. You may also need to register with your local municipality or county.

- Obtain financing: Most small businesses will need some form of financing to get off the ground. This could involve taking out a loan, seeking investment from friends and family, or applying for a grant. It’s important to carefully consider your financing options and choose the one that makes the most sense for your business.

- Set up a physical location: If your business requires a physical location, you will need to find a suitable location and set up your business there. This may involve leasing a storefront or office space, purchasing or leasing equipment, and hiring employees.

- Promote your business: Once your business is up and running, it’s important to promote it to potential customers. This can involve creating a website, using social media, attending trade shows and networking events, and advertising in local publications.

Starting a small business in the USA can be a lot of work, but it can also be extremely rewarding. By following these steps and putting in the effort, you can turn your business idea into a successful reality.

Best Insurance Companies for Small Business in USA

There are many insurance companies that offer coverage for small businesses in the United States. Some of the top insurance companies for small businesses include:

- The Hartford: This insurance company offers a range of coverage options for small businesses, including liability, property, and workers’ compensation insurance.

- Nationwide: Nationwide offers small business insurance options including liability, property, and business interruption coverage.

- State Farm: State Farm offers liability, property, and business interruption insurance for small businesses.

- Allstate: Allstate offers a variety of coverage options for small businesses, including liability, property, and business interruption insurance.

- Liberty Mutual: This insurance company offers liability, property, and business interruption coverage for small businesses.

It is important to shop around and compare quotes from multiple insurance companies to find the best coverage and price for your small business. It is also a good idea to consult with an insurance professional to determine the specific coverage needs for your business.

Type of Insurance for a Small Business in USA

Small businesses in the United States have a variety of insurance options to choose from to protect themselves and their employees. With so many options, it can be overwhelming to determine which type of insurance is best for your small business. Here are some factors to consider when choosing the best insurance for your small business:

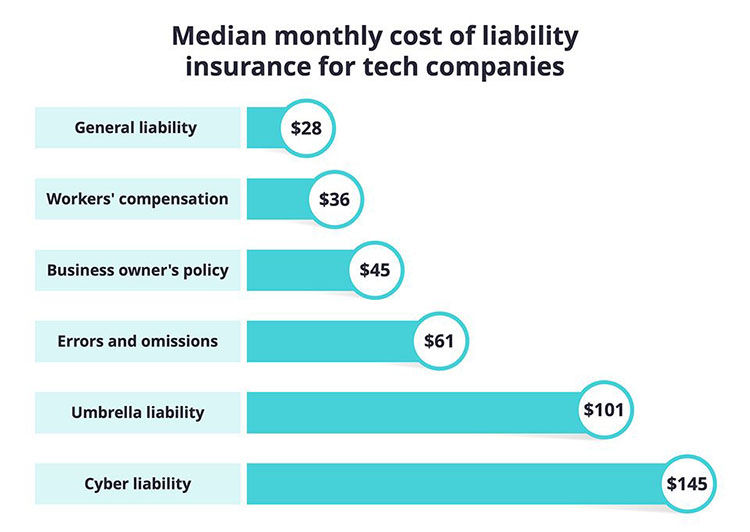

- Liability insurance: This type of insurance protects your business from legal responsibility for accidents or injuries that occur on your property or as a result of your products or services. If a customer slips and falls in your store, for example, liability insurance would cover the costs of their medical bills.

- Property insurance: This type of insurance covers damage to your business’s physical property, such as buildings and equipment. It also covers loss or damage to inventory or business documents.

- Business interruption insurance: This insurance covers the loss of income and pays for expenses, such as employee salaries, if your business has to close temporarily due to a covered event, such as a natural disaster.

- Health insurance: This type of insurance covers medical expenses for you and your employees. It is especially important to consider if you have a small business with employees, as it can help attract and retain top talent.

- Workers’ compensation insurance: If an employee is hurt at work, this insurance will pay for their medical costs and missed wages. It is required in most states for businesses with employees.

Ultimately, the best type of insurance for a small business will depend on the specific needs and risks of the business. It is important to carefully consider your business’s exposures and consult with an insurance professional to determine the best coverage for your specific needs.