Disability insurance is a type of insurance that helps protect individuals from the financial impact of an illness or injury that prevents them from working. In California, disability insurance is available through a variety of sources, including employer-sponsored group plans, individual plans, and state-run programs.

One of the main sources of disability insurance in California is through employer-sponsored group plans. Many employers in California offer disability insurance as part of their employee benefits package. These group plans are typically provided by insurance companies and are available to all employees who meet the eligibility requirements set by the employer. Group plans may be funded by the employer or the employee, or a combination of both.

In addition to employer-sponsored group plans, California residents can also purchase individual disability insurance policies. Individual plans are generally more expensive than group plans, but they offer more flexibility in terms of coverage and may be a good option for self-employed individuals or those who do not have access to group coverage through their employer.

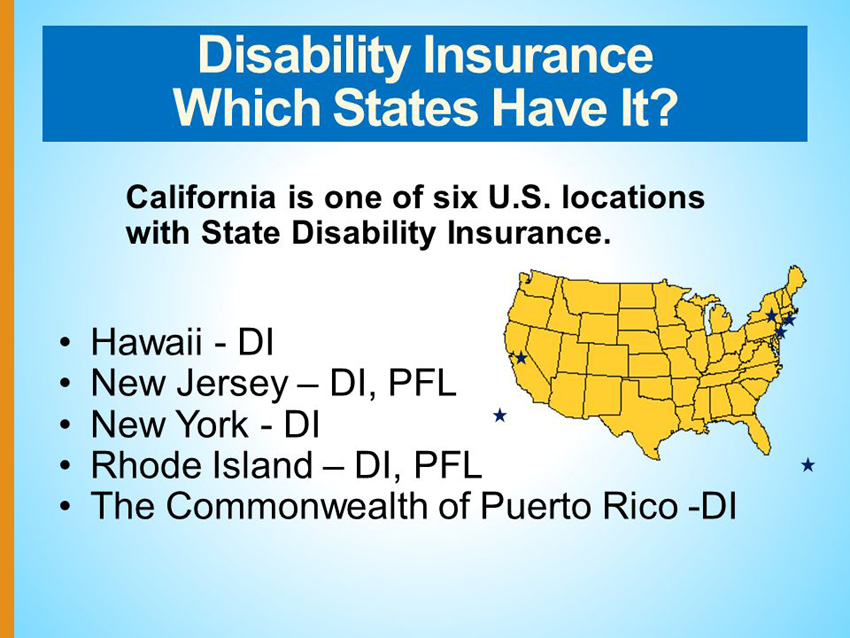

California residents who are unable to work due to a disability may also be eligible for disability insurance through state-run programs such as the State Disability Insurance (SDI) program. The SDI program provides short-term disability insurance to California workers who are unable to work due to a non-work-related illness or injury, pregnancy, or childbirth. The program is funded through employee payroll deductions and is administered by the Employment Development Department (EDD) of California.

It is important to note that disability insurance policies in California, whether group or individual, generally have a waiting period before benefits begin. The waiting period, also known as the elimination period, is the amount of time that must pass before an individual becomes eligible to receive benefits. The waiting period can vary depending on the specific policy, but it is typically between 7 and 30 days.

In addition to the waiting period, disability insurance policies in California also have a benefit period, which is the length of time that benefits will be paid. The benefit period can vary depending on the policy, but it is typically between 6 and 24 months. Some policies may also have a maximum benefit amount, which is the maximum amount of money that will be paid out over the benefit period.

It is important for California residents to understand the terms and conditions of their disability insurance policy, including the waiting period, benefit period, and maximum benefit amount. It is also important to carefully consider the amount of coverage needed, as the cost of disability insurance is often based on the level of coverage selected.

In conclusion, disability insurance is an important protection for California residents who may be unable to work due to an illness or injury. Disability insurance is available through employer-sponsored group plans, individual policies, and state-run programs, and it is important to carefully consider the terms and conditions of any policy before enrolling.

How much does disability pay a month in California?

The amount of disability pay an individual receives in California depends on the specific disability insurance policy and the individual’s income before the disability. Most disability insurance policies in California provide a percentage of the individual’s income, typically between 40% and 70%. For example, if an individual has a policy that provides 60% of their income and their income before the disability was $5,000 per month, their disability pay would be $3,000 per month.

It is important to note that disability insurance policies in California, whether group or individual, generally have a waiting period before benefits begin. The waiting period, also known as the elimination period, is the amount of time that must pass before an individual becomes eligible to receive benefits. The waiting period can vary depending on the specific policy, but it is typically between 7 and 30 days.

It is important for California residents to understand the terms and conditions of their disability insurance policy, including the waiting period, benefit period, and maximum benefit amount. It is also important to carefully consider the amount of coverage needed, as the cost of disability insurance is often based on the level of coverage selected.

In conclusion, the amount of disability pay an individual receives in California depends on the specific disability insurance policy and the individual’s income before the disability. Disability insurance policies in California have a waiting period, benefit period, and may have a maximum benefit amount. It is important for California residents to understand the terms and conditions of their policy and carefully consider the amount of coverage needed.

Disability Insurance companies in california

There are many disability insurance companies operating in California that offer a range of disability insurance policies to individuals and businesses. Some of the larger, well-known companies include:

- The Hartford: The Hartford is a leading provider of group and individual disability insurance in California and nationwide. The company offers a range of disability insurance options, including short-term and long-term disability coverage, as well as group and individual policies.

- MetLife: MetLife is a leading provider of group and individual disability insurance in California and nationwide. The company offers a range of disability insurance options, including short-term and long-term disability coverage, as well as group and individual policies.

- Unum: Unum is a leading provider of group and individual disability insurance in California and nationwide. The company offers a range of disability insurance options, including short-term and long-term disability coverage, as well as group and individual policies.

- Cigna: Cigna is a leading provider of group and individual disability insurance in California and nationwide. The company offers a range of disability insurance options, including short-term and long-term disability coverage, as well as group and individual policies.

- The Standard: The Standard is a leading provider of group and individual disability insurance in California and nationwide. The company offers a range of disability insurance options, including short-term and long-term disability coverage, as well as group and individual policies.

There are many other disability insurance companies operating in California, and it is important for individuals and businesses to carefully consider their options and select a policy that meets their specific needs and budget. It is also a good idea to compare quotes from multiple companies to ensure that the best policy and coverage is obtained at a competitive price.